NFTs, or non-fungible tokens, are undoubtedly something you’ve heard of if you keep up with the most recent financial headlines. NFTs are a component of the blockchain, just like cryptocurrencies, and they signify ownership of a single digital asset.

NFTs, however, are far more multifaceted than the typical cryptocurrency: These assets frequently represent actual things in the real world, including works of art, music, tweets, and even actual and virtual real estate. While the item is visible (and even copyable) to anyone online, the blockchain keeps track of the real owner.

It’s possible that you’ve already begun learning more about NFTs. But considering how novel this idea is, it’s more likely that you’re interested in learning how these digital assets may be used to generate income.

As art NFTs are the most generally used application of NFTs, we will focus on them in this post. We will also discuss how to start using each of the three most popular ways to get money from NFTs.

The Quick Take:

• NFTs give artists a method to monetize their work and reach new audiences outside of the traditional art scene, which is infamously difficult to enter into.

• You need a cryptocurrency wallet and an account with an NFT marketplace whether you’re making and selling your own NFTs or just purchasing them.

• You can stake and hold NFTs in addition to buying and selling them to get some small passive revenue.

• Since NFTs are still purely speculative and unproven, you should never invest more money than you can afford to lose. And never include it into your long-term financial plan.

Making Money With NFTs

The newest development in the world of investing is NFTs. Additionally, they offer a chance to generate money even if they can be complicated at first. Some have actually sold for millions of dollars! With NFTs, there are three main ways to generate income:

• Making and marketing your own NFTs

• Purchasing NFTs produced by others.

• Staking your NFTs or lending them

Here, we examine each of these tactics in more detail.

1. Develop and Market Your Own NFTs

The chance they have provided for artists is one of the reasons NFTs have grown to be so well-liked. The traditional art industry has proven to be tough to break into, in part because there are gatekeepers who make it difficult for emerging artists to establish themselves.

Artists can bypass those gatekeepers thanks to NFTs and the blockchain. They can instead create art and sell it straight to the general population. They not only have an easier time breaking into the art market, but they also get to keep more of the money they make from their sales when they don’t have to split it with agents, gallery owners, and other people. The best news is that producing and selling an NFT is much simpler than most people may realize.

Setting Up a Crypto Wallet is Step 1

Blockchain technology is used to run NFTs, much like it is for cryptocurrencies. Therefore, you won’t be able to use your regular payment methods for NFT transactions; instead, you’ll need bitcoin and a wallet to store it in. Make sure to select a wallet that is compatible with Ether because the majority of NFTs are on the Ethereum blockchain.

Step 2: Link your wallet to an NFT platform.

Finding the ideal platform to create and sell your own NFTs is the next step. In a sense, the NFT platform serves as the storefront where others can purchase your artwork. It’s similar to displaying your handmade goods on Etsy when you list your art on an NFT site.

There are many NFT platforms available, but OpenSea is one of the most well-liked. You won’t need to look for innovators on your own if you start on this platform because you will have access to the website’s many users. You should connect your cryptocurrency wallet to your OpenSea account once you’ve made one.

Create Your NFT Collection in Step 3

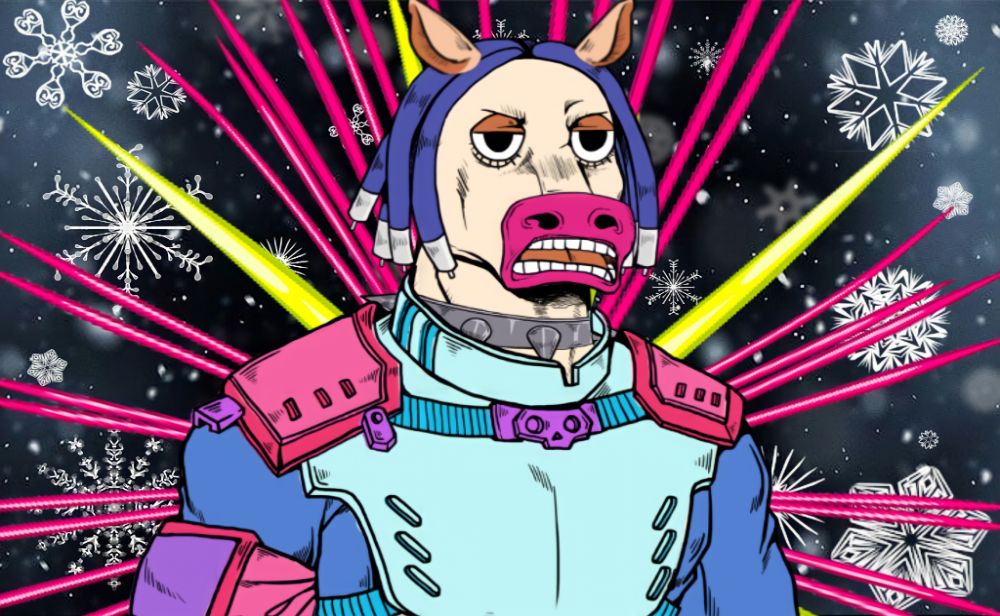

Your NFTs are kept in what is referred to as a collection on OpenSea. On the NFT platform, your collection functions as a private storefront where all of your artwork is available for purchase. You must upload a logo, featured image, banner, collection name, and other items while building up your collection. A royalty percentage, or the amount you will receive from each sale when an investor resells your artwork, can also be specified. The advantage of royalties is that you profit from every sale of your artwork, not just the first one.

Add Your Art to the Collection in Step 4

When your collection is ready, you may begin including the pieces of art that will eventually make up your NFT. The good news is that almost any digital file, including JPG, PNG, GIF, SVG, MP4, WEBM, WAV, and more, may be converted into an NFT. Many well-liked NFTs are just photos or GIFs.

List Your NFT For Sale in Step 5

It’s time to put your NFTs up for sale after you’ve added them to the collection. You can choose the price you want to charge for each work of art. You can either set a fixed price for the asset or accept bids, with the winning bidder receiving the item.

2. Put cash into NFTs

You can still profit from your NFTs even if you are unable to manufacture them, just like you can with any other investment in the arts. Investing in NFTs enables you to gain money when the asset appreciates while you possess it, as opposed to receiving payment for your labor. The objective is to eventually sell the asset for a profit, demonstrating a return on your investment. We’re here to explain it to you if you’re unfamiliar with the world of NFTs and don’t even know where to begin investing.

Step 1:Setting Up a Crypto Wallet

You’ll need bitcoin to buy NFTs, just like when you make and sell NFTs. Make sure to select a wallet that is compatible with Ether because the majority of NFTs are on the Ethereum blockchain.

Step 2: Select an NFT Marketplace

Investors can purchase and sell digital assets on a number of NFT markets. OpenSea is one of the most well-known NFT platforms right now, as we’ve already mentioned, but you may find others that might be more suitable for your purposes by conducting a fast internet search.

Step 3: Examine the NFT You Wish to Purchase

Upon arriving at an NFT marketplace, you can begin looking for NFTs. Typically, you can browse assets by category or just browse the platform’s current selection of significant new NFTs.

Step 4: Buy a cryptocurrency

As we previously indicated, bitcoin is typically required rather than a standard debit or credit card to purchase NFTs. Make sure you purchase an amount sufficient to pay the price of the NFT you are considering. The cryptocurrency you just purchased will subsequently be placed in your online wallet.

Step 5: Purchase the NFT

You can buy NFT once you’ve bought your coin and have it in your digital wallet.

3. Invest or Lend Your NFTs

Your NFTs are transferred into a locked-up account when you stake or lend them, where you will receive a yield on the contract for as long as you keep the NFT there.

Lending or staking your NFTs is the last way to profit with NFTs. With the rise of cryptocurrencies, these passive income streams have gained popularity, although they aren’t really that dissimilar from other means of generating income in the conventional financial industry (with a high-yield savings account, for example).

Your NFTs are transferred into a locked-up account when you stake or lend them, where you will receive a yield on the contract for as long as you keep the NFT there. In some situations, you lend your NFT to a particular person (or people), who are effectively renting it from you. As soon as the other party deposits their collateral, you deposit your NFT into an escrow account. They receive the NFT as compensation for the period of the contract, and you receive the agreed-upon rental fee.

For the owner of the NFT, this form of income is entirely passive and advantageous for a number of reasons. First of all, it enables you to earn a little money for something that would otherwise probably simply sit there. Additionally, it enables you to obtain the money you require if you’re short on cash without having to sell your NFT. In either scenario, you gain both the short- and long-term benefits of the lending or staking earnings and any NFT appreciation.

Remember that NFT staking or lending is still an emerging idea, even more so than NFTs as a whole. This process will probably modify and advance going forward as a result. Furthermore, there aren’t many systems that let you use the NFTs you already own to generate this kind of passive revenue. The two examples are ReNFT and NFTX.

Frequently Asked Questions

What is the Price Range for Creating an NFT?

The process of actually producing a non-fungible token (NFT) can be carried out at no cost at all; however, there is a fee involved in listing it for sale on an NFT platform. For example, in order to cover the cost of the function on the blockchain, OpenSea implements something that is referred to as a “gas fee.” The price of this gas fee is subject to change and is influenced by the number of users who are conducting transactions on the network at any given moment.

What Happens Once You Have an NFT in Your Possession?

You might be wondering what the next step is at this point in the story. The ownership of an NFT is comparable to the ownership of any other kind of investment. You should keep it for the time being and keep your fingers crossed that its worth will go up so that you may eventually sell it for more than you paid for it. You can sell your NFT on the same NFT marketplace where you bought it in the first place if you ever make the decision to sell it, which you could do for a number of reasons including the fact that its value has increased or the fact that you just no longer desire it. It is essential to keep in mind that, despite the fact that the idea of investing in an appreciating asset could be comparable to investing in stocks, the two investments actually involve completely distinct assets. When you make an investment in a stock, the price of that stock is generally determined by two factors: the current market as well as the success of the firm. On the other hand, the performance of an NFT is not dependent on the performance of a specific company. As a consequence of this, shifts in its value are sometimes subject to a degree of arbitrariness. In addition, it is impossible to forecast what the future holds for your investment in NFTs because there is no established track record of NFT success in the same way that there is for the performance of stocks on the stock market.

How Much Money Is Possible to Make by Developing and Selling NFTs

When it comes to the amount of money you can make by making and selling your own NFTs, there is no cap. There are many well-known pieces that have been sold for tens of thousands, hundreds of thousands, and even millions of dollars. You can still make a respectable amount of money even if you are an artist, even though you may not be able to achieve the same degree of success as other artists. In addition, if your artwork has a high market value and is resold more than once, you may be entitled to royalties for each of these further sales, which can provide you with an extra stream of passive income.

The Dangers Involved in Investing in NFTs

If you want to make a profit off of your investments in non-fungible tokens (NFTs), you should be aware that there are some significant dangers involved in either trading existing NFTs or generating your own.

First, it’s important for artists to understand that making and selling NFTs is not an easy way to make money. The unpleasant reality is that the vast majority of artists who sell their work online will not get wealthy as a result of their sales of non-functional tokens (NFTs). In point of fact, it’s possible that many don’t make any money at all. It is essential to have a strategy for promoting your non-fiction texts in addition to the artwork that you create for them.

The act of releasing your work on an internet forum is not without its share of potential downsides. Sadly, the work of a great number of artists has been stolen by others, who then attempt to pass it off as their own and profit from it. In many instances, the platforms do not have a system in place to safeguard the artists that use their services. In point of fact, Opensea only recently came clean and revealed that more than eighty percent of the things that had been placed on its platform through the use of its free minting tool were either fakes or scams.

Investors who acquire the artwork created by other individuals face an increased risk as a result of this theft. You face the risk of purchasing a digital asset that is either fraudulent or plagiarized if it is too simple for someone to take a work of art and pass it off as their own NFT. This is due to the fact that it is too simple for someone to steal a work of art.

And the possibility of purchasing a non-fungible token that has been plagiarized is not the only danger that ordinary investors face. In contrast to other asset classes, the performance of NFTs is not backed by an established track record. As a consequence of this, investors ought to allocate a sizeable proportion of their capital to the purchase of NFTs. If you do nothing else, you should think about using some of your budgeted “fun money” to patronize some artists whose work interests you or to dabble in some asset class that piques your curiosity. Nevertheless, you shouldn’t count on these investments to be a significant part of your long-term financial strategy.

The Crux of the Matter

It is essential, before to investing money in NFTs, to have a thorough understanding of the dangers that are involved with those investments. Because they are a relatively new asset, it is impossible to predict how well investments in NFTs will do in the future. Rather than placing all of your money into these digital assets, you should instead set aside a small piece of your portfolio for them and only invest money that you can afford to lose in these assets.